☑️ Pay In Full discount of 20%

☑️ Better than Average driver discount up to 20%

☑️ Preferred rates for Higher Liability limits

☑️ Guaranteed Replacement Cost

☑️ Accident Forgiveness

☑️ Quick quote indication to your email

☑️ Liability Protection up to 500,000

National General Car Insurance

Started as GMAC Insurance Group in 1920 exclusively for General Motors employees and in 2013 GMAC changed their name to National General Insurance

They are A+ XV Superior Rated by AM Best and currently write car insurance in all 50 states

Currently 2 billion or greater in policyholder surplus so National General is one of the largest insurance companies in the United States

Who is the best fit for NatGen?

☑️ Preferred driving records (clean 3 years)

☑️ Current Liability limit above 15/25

☑️ Very Good to Excellent Credit Worthiness

☑️ GM vehicle discount

☑️ 1:1 Vehicle to Driver Ratio

☑️ Homeowner

Request your NatGen Car Insurance Proposal

click the button to get started

Coverage Options

Accident Forgiveness

Most insurance companies don’t offer this coverage

This allows you to have an At Fault accident and not get surcharged (rate increase) an additional amount at renewal

Yes you may get placed into a different rating tier and see an increase but its not going to be as high as an At Fault accident on your record

When you have a clean driving record you have an asset you need to protect

You protect your clean driving record with Accident Forgiveness

Accident Forgiveness is also great for average to below average drivers that have remained clean for 3 years

Locking in the clean driving record is something to consider if your car insurance company does offer the coverage

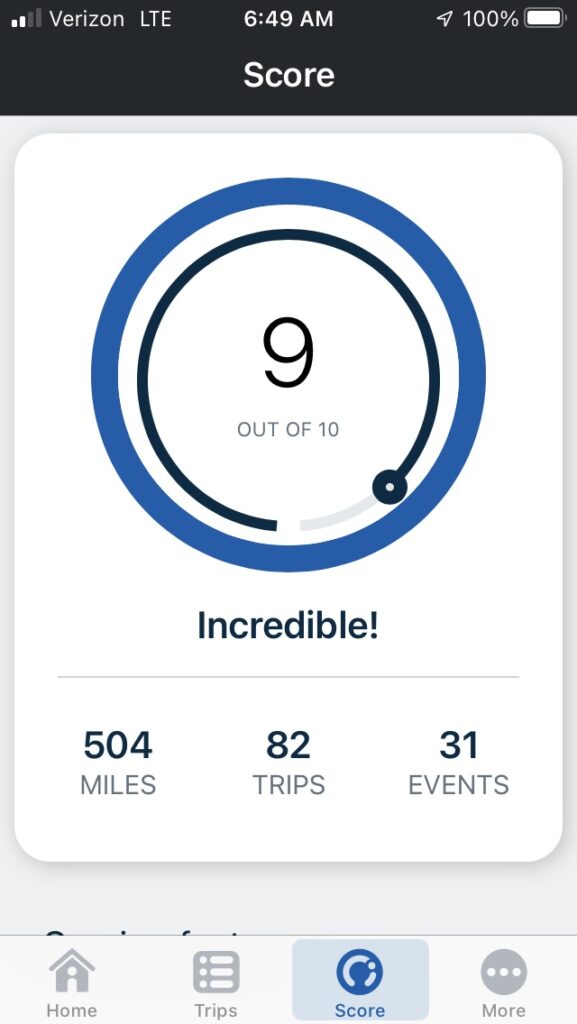

Better than Average Driver Discount

Car Insurance rates are based on the average driver not the better than average drivers

If you think you are better than average and you have a clean driving you now have the opportunity to prove it to the insurance company

The Insurance industry term is Telematics

It is an app you download on your phone and that’s it

The insurance company will review speed, braking, acceleration and time of driving

You will get 10% off your current rate just to try it

After a few months you can get up to an additional 20% if you really are a good driver

Its not for everyone but for 10% off why not give it a try?

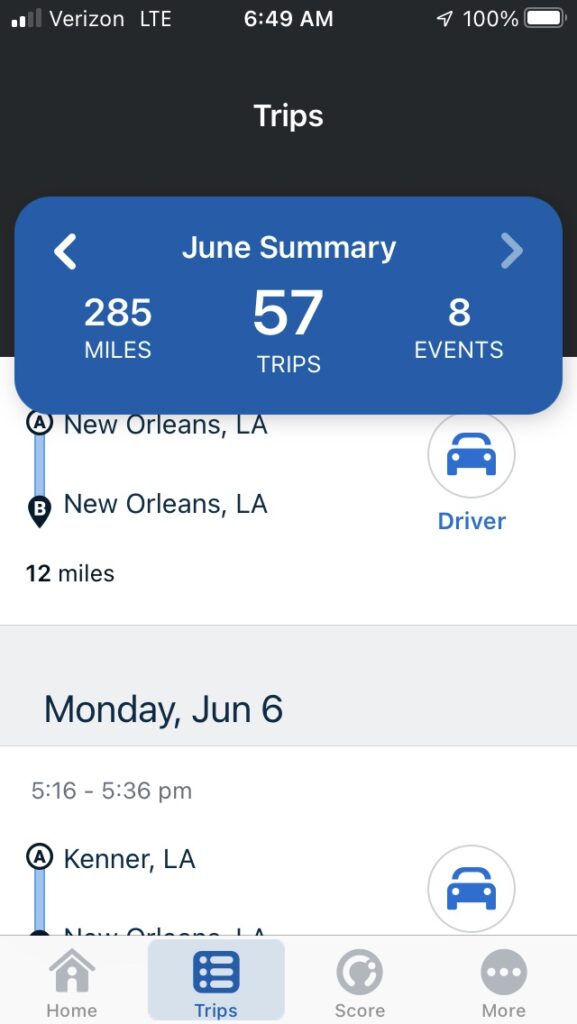

Here are the screenshots from the Routely app on my phone

I downloaded the app and added the 5 digit code NatGen sent me and that was it

FAQs about National General Dynamic Drive Program click here

Request your NatGen Car Insurance Proposal

click the button to get started

Uninsured Motorists

All insurance companies offer this coverage but most drivers decline this coverage

I like to think it was just never explained and once a customer reads “optional” it gets declined

If you are still employed I consider this one of the most important coverage options available to you

Insurance Companies want you to buy low liability limits and reject Uninsured Motorists coverage

Why?

Because it will limit the amount they pay on the policy (limits their exposure)

A few things to consider about Uninsured Motorists

1) When you add Uninsured Motorists coverage to your policy you are adding Liability insurance to every vehicle on the road so you no longer have to worry about uninsured drivers

Most drivers are either uninsured or under insured which is basically not enough to take care of you and your family if the other driver is at fault

When you buy Uninsured Motorists limits of let’s say 250,000 you no longer have to worry if the texting teenager smashes into your vehicle and has enough or has any insurance

You do

You would have 250,000 of coverage for lost wages, medical bills and mental difficulties you may experience

2) Uninsured Motorists is basically disability insurance when traveling in your car

Without it and you miss work and the other driver has no insurance or only minimum limits who is going to compensate you for your lost paycheck?

Miss a week or two hurts but what if you are out of work for 6 months?

If you are employed you must have Uninsured Motorists Coverage

Your ability to earn an income is your most valuable asset so adding Uninsured Motorists helps protect you if you are a wage earner

If you purchase 250,000 of Uninsured Motorists you can qualify for 1,000,000 of additional coverage with a Personal Umbrella policy if you are afraid your ability to earn an income could be limited for years

Request your NatGen Car Insurance Proposal

click the button to get started

Hi there, I’m Tim D’Angelo

INSURANCE ADVISOR

Owner of FM Agency Group and FM Risk helping customers with Insurance since 2003